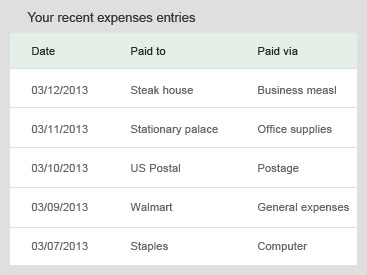

Expense tiles are provided for most typical business expenditures (e.g., travel, hotel, meals, etc.).

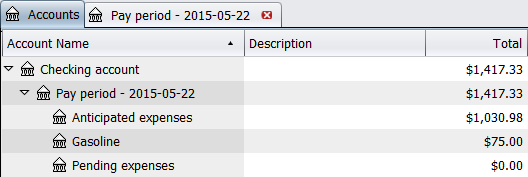

#Expense account code

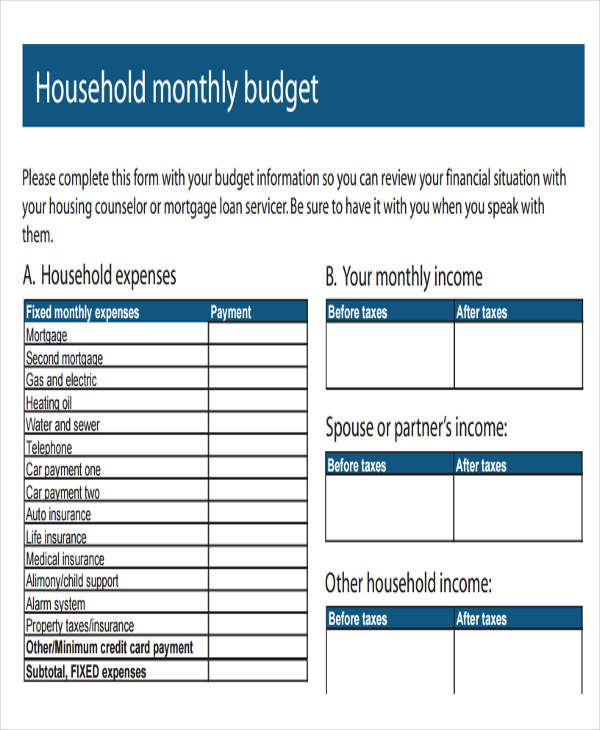

The Expense Report is designed to record business expenses by 13-digit budget account number, which includes fund (2 digit), unit (2 digit), location (2 digit) and identifier/department (7 digits) and 5-digit object code (or expense category). Supervisor and Budget Officer approval indicates that he/she examined the Expense Report in detail, verified the appropriateness of expenditures in accordance with University policy, verified the accurate completion of the form, and is satisfied with the amount claimed as reimbursable expenses by the traveler. The Expense Report must be certified by the traveler. Receipts must be submitted for all expenses.Īny unusual items or special circumstances causing a policy deviation should be fully explained within Chrome River. At a minimum, the name of the payee and guest(s), date and amount should appear on the receipt.

#Expense account full

NOTE: Photocopies of invoices, credit card statements or record of charge slips accompanying the monthly billing statement, receipts or restaurant stubs are not acceptable unless the original document was lost and a detailed description is provided in the Expense Report giving a full explanation of circumstances.Ī receipt is defined as a written acknowledgement that a specified remittance, article or delivery has been made. Other Transportation: Receipt or bill and documentation of points of origin and destination.Telephone: Hotel bill or telephone bill.

#Expense account registration

0 kommentar(er)

0 kommentar(er)